|

|

||

|

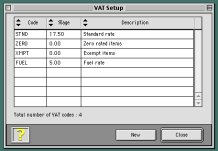

VAT Setup |

|||||

|

|

If you need to track VAT in your cashbook file, here is where you may set up your VAT codes, rates and descriptions. You may enter up to 100 different codes, if you wish, but note that each code must be unique. If you do not wish to track VAT, you do not need to do anything is this window, you just need not select a VAT code when making entries elsewhere in the program. Creating

A New VAT Code Altering

An Existing VAT Code If you wish to change any of the information about a VAT code, such as the rate or code itself, this change will not affect any cashbook entries which have already been created. Sorting

Columns |

||||